United States High Speed Steel Industry Growth Forecast Set to Reach USD 5.1B by 2032 | Industry Size, Share & Trends

High Speed Steel Market Outlook 2025–2032 | Key Drivers & Future Opportunities

High Speed Steel Market Growth in USA | Valued at USD 3.1 Billion in 2024, Forecast to 2032”

AUSTIN, TX, UNITED STATES, October 30, 2025 /EINPresswire.com/ -- High-Speed Steel (HSS) Market Analysis— DataM Intelligence 4Market Research LLP

Market Overview

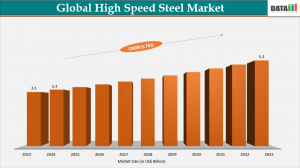

According to DataM Intelligence Comprehensive Report, The high-speed steel market size was valued at US$ 3.1 billion in 2024 and is projected to reach US$ 5.1 billion by 2032, expanding at a CAGR of 5.76% between 2025 and 2032,

HSS remains a cornerstone in cutting tools, drills, and machining operations due to its superior hardness, heat resistance, and durability. In the U.S., the market benefits from strong manufacturing and automotive demand, coupled with technological upgrades in CNC machining and additive manufacturing.

Market Size, Share and Growth

2024 Market Size: US$ 3.1 Billion

2032 Projected Market Size: US$ 5.1 Billion

CAGR (2025-2032): 5.76%

Largest Market: Asia-Pacific

Fastest Market: Asia-Pacific

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):– https://www.datamintelligence.com/download-sample/high-speed-steel-market

Key Industry Developments

In July 2023, Syntagma Capital completed the acquisition of Erasteel, the high-speed steel and recycling division of Eramet SA.

In April 2022, JFE Steel Corporation and ThyssenKrupp Steel Europe jointly introduced new high-strength steel sheets (980 MPa and 1180 MPa grades)

designed for cold-formed vehicle frame components.

In June 2024, Erasteel became the world’s first high-speed steel (HSS) producer to earn EPD certification, covering both conventional steels and materials derived from recycled batteries and spent oil catalysts. This achievement sets a new standard for sustainability and transparency, showcasing the use of over 91% recycled content and reinforcing the alignment of high-performance steels with circular economy goals.

Market Drivers & Trends

According to the International Air Transport Association (IATA), global passenger traffic is projected to double by 2040, boosting demand for precision-engineered components and high-speed steel (HSS) tools.

In June 2024, Erasteel became the first global HSS producer to earn EPD certification, using over 91% recycled materials a major step toward sustainability and circular manufacturing.

In India, vehicle production surged to 28.4 million units in FY 2023–24, up from 25.9 million, according to SIAM. The sharp rise in passenger and utility vehicle sales has fueled demand for HSS cutting tools used in machining engines, gears, and precision parts.

In the U.S., the aerospace and defense industry recorded US$ 955 billion in sales in 2023, up 7.1% year-on-year, highlighting its reliance on durable and precise HSS tools for turbine blades and aircraft components.

Overall, the automotive sector remains the leading end-user, accounting for about 30.7% of the global HSS market in 2024, driven by rising vehicle production and the need for high-performance, long-lasting tooling solutions.

Challenges & Restraints

Competition from Carbide and Ceramic Tools: Carbide tools offer higher cutting speeds for specific applications, slightly limiting HSS demand.

Raw Material Volatility: Prices of tungsten, molybdenum, and vanadium impact manufacturing costs.

Environmental Compliance: Stricter emissions and recycling standards may raise operational costs.

Key Players

Leading market participants include:

1. Sandvik AB

2. Bohler-Uddeholm (voestalpine AG)

3. Kennametal Inc.

4. Yamawa MFG Co., Ltd.

5. Nachi-Fujikoshi Corp.

6. OSG Corporation

7. Voestalpine AG

8. NIPPON STEEL CORPORATION

9. Fushun Special Steel Co., Ltd.

10. Daido Steel Co., Ltd.

11. Graphite Limited

12. ArcelorMittal S.A.

13. Heye Special Steel Co., Ltd.

14. Hudson Tool Steel Corporation

15. West Yorkshire Steel Co., Ltd.

These companies focus on product innovation, sustainable metallurgy, and AI-integrated machining solutions to remain competitive in a high-performance tools market.

Get Customization in the report as per your requirements:- https://www.datamintelligence.com/customize/high-speed-steel-market

Regional Insights

United States

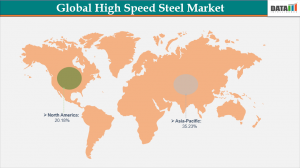

The U.S. accounts for nearly 22% of the global HSS market. Continuous industrial automation and adoption of advanced alloys by Kennametal, Sandvik Coromant, and Bohler-Uddeholm sustain market growth.

Asia-Pacific Dominates Global High-Speed Steel Market

Asia-Pacific leads the global high-speed steel (HSS) market, holding around 35.23% share in 2024, driven by China’s massive machine tool and automotive industries. China produced over 1 billion metric tons of crude steel in 2023, strengthening its raw material base for specialty steels. Japan and South Korea focus on premium HSS for aerospace, electronics, and high-precision automotive parts, leveraging advanced metallurgy and tool-making expertise.

India: Rapid Growth Fueled by Manufacturing and Automation

India’s HSS market is expanding swiftly, supported by the “Make in India” initiative, a booming automotive sector, and increased industrial automation. Rising aerospace, construction, and CNC machining activities are further propelling demand for high-performance HSS tools.

China: Major Global Supplier and Innovator

China dominates over 40% of the regional HSS market, with major producers like Tiangong International and Baosteel Special Metals scaling output to meet demand for affordable tools. Premium players such as Nachi-Fujikoshi and Hitachi Metals continue to lead in precision cutting applications, while global companies like Voestalpine expand through local collaborations.

North America: Advanced Infrastructure and Steady Demand

North America accounts for about 20.18% of the global HSS market in 2024, driven by strong industrial infrastructure and consistent demand from automotive, aerospace, and manufacturing sectors. Despite competition from carbide tools, HSS remains preferred for its durability, shock resistance, and cost efficiency.

Canada: Stable Growth in Aerospace and Resource Sectors

Canada’s HSS demand is driven by its aerospace leaders (Bombardier, Pratt & Whitney Canada) and resource industries (mining, oil & gas). With a growing advanced manufacturing base in Ontario and Quebec, the market is expected to expand moderately, supported by consistent industrial applications.

Asia-Pacific

The region holds the largest market share (over 45%), with China and India as major producers and consumers due to rapid industrialization and expanding automotive production.

Market Segmentation

By Product: (Metal Cutting Tools, Cold Working Tools, Others)

By Grade: (M Grade, T Grade, C Grade, V Grade)

By Production Method: (Conventional HSS, Powder Metallurgy (PM) HSS, Spray Forming (SF) HSS)

By End-User: (Automotive, Aerospace, Energy Sector, Plastic Industry, Others)

By Region: (North America, South America, Europe, Asia-Pacific, Middle East and Africa)

Buy Now & Unlock 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=high-speed-steel-market

DataM Intelligence Insights & Recommendations

DataM suggests three strategic pathways for future growth:

Investment in eco-friendly alloy compositions to align with global sustainability goals.

Integration of digital twins and predictive analytics in machining operations to enhance efficiency.

Expansion into high-growth Asia-Pacific regions, leveraging cost-effective production bases.

As manufacturing reindustrializes globally, high-speed steel’s blend of durability, recyclability, and cost-effectiveness positions it as a core enabler of precision engineering through 2032.

Have any Query? Talk to our Expert @ https://www.datamintelligence.com/enquiry/high-speed-steel-market

Related Reports:

Ultra-High Strength Steel Market

Steel Market Size

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.